E-WAY BILL

E-Way Bill is an electronic way bill for movement of goods which can be generated on the eWay Bill Portal. Transport of goods of more than Rs. 50,000 (Single Invoice/bill/delivery challan) in value in a vehicle cannot be made by a registered person without an eway bill.

Alternatively, Eway bill can also be generated or cancelled through SMS, Android App and by Site-to-Site Integration(through API).

When an eway bill is generated a unique eway bill number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

Who should generate the e-way bill and why?

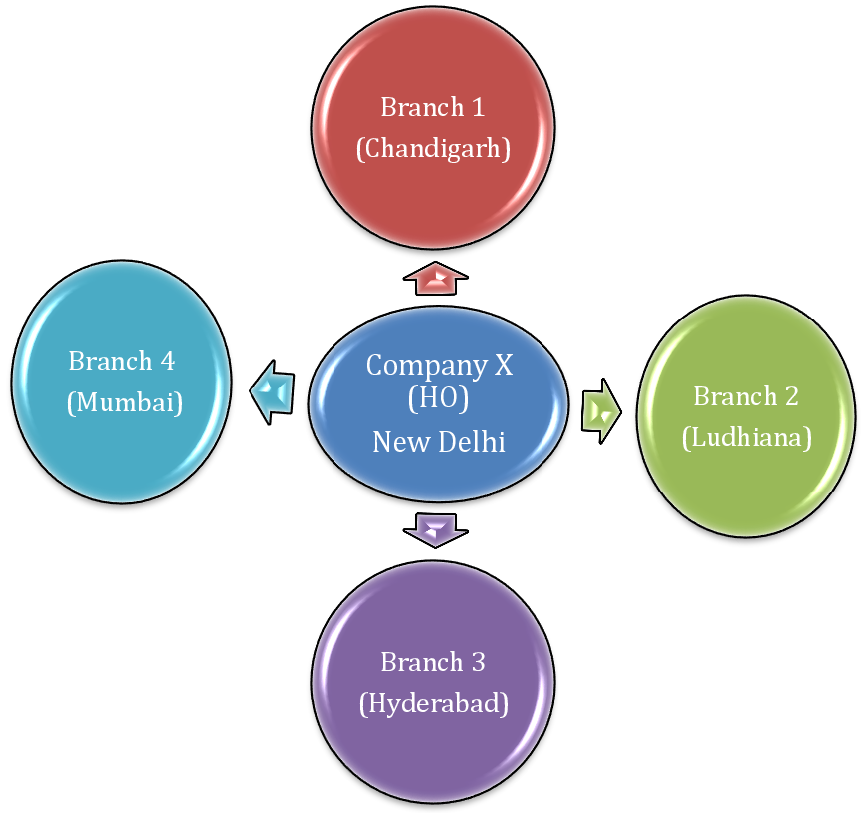

- E-way bill is to be generated by the consignor or consignee himself if the transportation is being done in own/hired conveyance or by railways by air or by Vessel. If the goods are handed over to a transporter for transportation by road,E-way bill is to be generated by the Transporter.

- Where neither the consignor nor consignee generates the e-way bill and the value of goods is more than Rs.50,000/- it shall be the responsibility of the transporter to generate it. Further, it has been provided that where goods are sent by a principal located in one State to a job worker located in any other State, the e-way bill shall be generated by the principal irrespective of the value of the consignment.

- Also, where handicraft goods are transported from one State to another by a person who has been exempted from the requirement of obtaining registration, the e-way bill shall be generated by the said person irrespective of the value of the consignment.

Validity of E-Way Bill?

- The validity of e-way bill depends on the distance to be traveled by the goods. For a distance of less than 100 Km the e-way bill will be valid for a day from the relevant date.

- For every 100 Km thereafter, the validity will be additional one day from the relevant date.

- The “relevant date” shall meanthe date on which the e-way bill has been generated and the period of validity shall be counted from the time at which the e-way bill has been generated and each day shall be counted as twenty four hours.

When is E-Way applicable?

- E way Bill is applicable from 1 April 2018 for inter-state movement of goods worth Rs 50000 or more.

- For intra-state movement of goods, state wise date is mentioned in chart below: