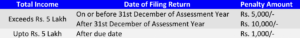

After section 234E of the Income-tax Act, Section 234F has been inserted with effect from the 1st day of April, 2018. (Applicable for returns file from Assessment Year 2018-19 and onwards)

Fees for default in furnishing return of income – where a person required to furnish a return of income under section 139, fails to do so within the time prescribed in sub-section (1) of 234F, he shall be liable to pay penalty as follows:

Who is required to file Income Tax Returns?

It is mandatory for the persons belonging to following categories to file Income Tax Returns:

-

An Salaried Individual whose income exceeds basic exemption limit of Rs 2.50 lacs

-

Individuals having income other than salary exceeding Rs 2.50 lacs

-

Company/Firm/Proprietorship Firms

-

Individual having clubbed income exceeding the non-taxable slab rate of Rs 2.50 lacs