Companies Audit (Applicability, Procedure, Provisions, etc )

The audit is a refined way of finding irregularities.

Audit for commercial entities was proposed to make it simpler for officials and government agencies to affirm their way of doing business. It is not feasible for the government to assure for each entity that its presented tax figures, sales reports, debt values, etc are fair and are up to the mark to be fairly reported to the general public and especially to the investors. In India, entities especially “Companies” registered under the Companies Act, 2013 have to undergo certain audit provisions on a mandatory basis. Audit of Indian companies presents a comparative analysis of the company’s books of accounts and all its financial records. An auditor for the audit of the company is appointed which places his conclusive remarks on the company’s performance before the general public for their better reliance on the company.

The post below gives an overview of all audit provisions applicable to the companies and how such provisions bring compliance responsibilities to its members.

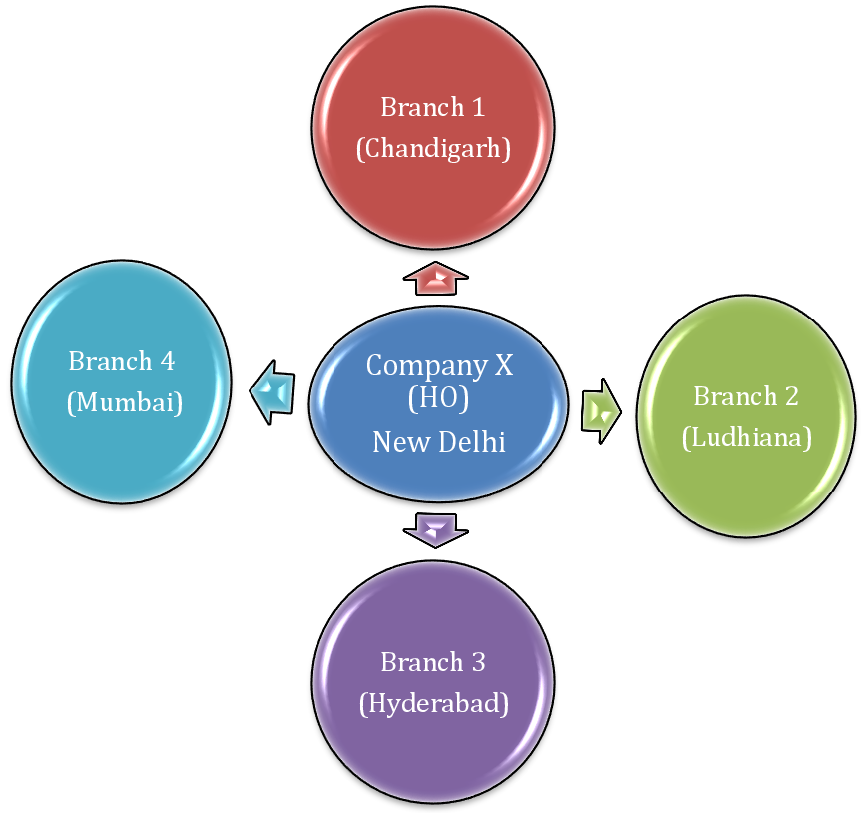

Taxgoal.in is an online consultation agency for Companies Audit services in Delhi or other major parts of the country. It seeks to serve all tax-abiding agencies and entities in the country. As a company audit service provider in Delhi we provide services in all domains like company audit services, statutory audit services, annual return filing, company director KYC compliance, Income tax and GST audit services, bookkeeping, etc. Not limited to the agency holds a consultation team for handing client queries related to trademark filing, GST registration, director registration, SEBI & RBI compliances, Registrar compliances, etc.

Need a customized package on Companies Audit services in Delhi or around?

Email us at support@taxgoal.in

Companies Audit – Meaning

Companies undergoing a Statutory Audit from an Auditor appointed under Section 139 requires a complete scanner over its books of accounts and financial records, where after doing an independent inspection, the auditor mention his views on compliance practices and performance of the company while preparing an audit report.

As per the Company audit rules, a public limited company has to close its financial accounts every year and prepare its financial statements to depicts its affairs fairly . Irrespective of any criteria of being a small or big company, the company has to get its accounts audited from the auditor.

With his views placed before the company members and audit committed, the auditor prepares a statutory audit report and submits it to the company to comply with ROC Filling norms. After receipt of the statutory report, the company is required to file such reports and observations of the auditor to the MCA (Ministry of Corporate Affairs ) and to the Company Registration while filling its ROC Annual returns.

Company Audit – Applicability of Audit & Auditor Appointment

Applicability of Statutory Audit

Section 139 to 147 of the Companies Act,2013 prescribes for the appointment of a Statutory Auditor in a company to oversee accuracy and representation of the final records of such company. Irrespective of nature, class, and turnover of business of the company, every company registered under the Act, have to appoint a Statutory Auditor and get a Statutory Audit conducted in the business.

An LLP firm has to appoint a Statutory Auditor, only if its turnover of business crosses Rs 40 lakh or if capital contribution in the business is more than Rs 25 lakh.

Appointment of Statutory Auditor in the Company

A Statutory auditor is appointed as a vigilant person to present his fair views about the company’s affairs and his opinions towards the general public through its statutory audit report. A Statutory auditor in a company is appointed for a minimum term of 5 years.

-

Eligible persons to become a statutory auditor of a company:

- Chartered Accountants in Practise

- Registered firm of Chartered Accountants

- An LLP ( Limited Liability Partnership ) firm when a majority of partners are Chartered Accountants in Delhi.

-

Non- Eligible Persons to be Statutory Auditors of A Company:

- Employee, Partner, director or any officer of the Company

- Anybody corporate other than LLP

- Any person convicted by a court in offense of fraud and if 10 years has not been elapsed from his conviction.

* Form ADT – 1 as available on the MCA Portal has to be complied for the appointment of Companies Auditor.

Rights of Statutory Auditor:

In lieu of Companies audit, a Statutory auditor has the following rights :

- Right to access books of accounts of the Company ;

- Right to attend to the General meeting of the Company ;

- Right to question or seek information from officers of the Company.

Companies Audit – Procedure

Audit of Company requires in-depth and independent inspection of the company’s books of accounts, departmental reports, financial decisions and transactions crucial to investors. There is no specific format or guidelines for prescribing the manner of conduct of audit by the Statutory auditor in the company. While the basic flow for the conduct of Company audit by the auditor can be :

- Inspect books of Accounts and related crucial transactions (Loans and Advances, Sale of Investments, Allotment of Shares, etc ) .

- Enquire from Company representatives.

- Draft an Audit Report

- File conclusions to the Central government, Audit Committee, and to the members of the company.

After all observations and conclusions, an Audit Report is to be prepared following provisions of Section 143. If an Audit Committee has been formed as per Section 177 of the Companies Act, the report so formed by the Auditor is to be submitted to the Committee for further clarifications from the Company Members.

Note: The report must follow the auditing standards recommended by ICAI.

Companies Audit – Penalty for Contravention

For contravention or ignorance of provisions of Section 139 to Section 146, the company in default shall become liable to pay a penal fine of Rs 25,000 which can even extend up to Rs 5 lakh. Also, every officer in default shall be imprisoned for a minimum term of 1 year or be punished with a fine of Rs 10,000 to Rs 1 lakh or both.

Need Assistance on Companies Audit Services in Delhi or anywhere in India?

Email us your concern at support@taxgoal.in Or Place us a call at +91 9138531153