GST Annual Return in Delhi

File GST Return -9 before the due date of 30th November 2019

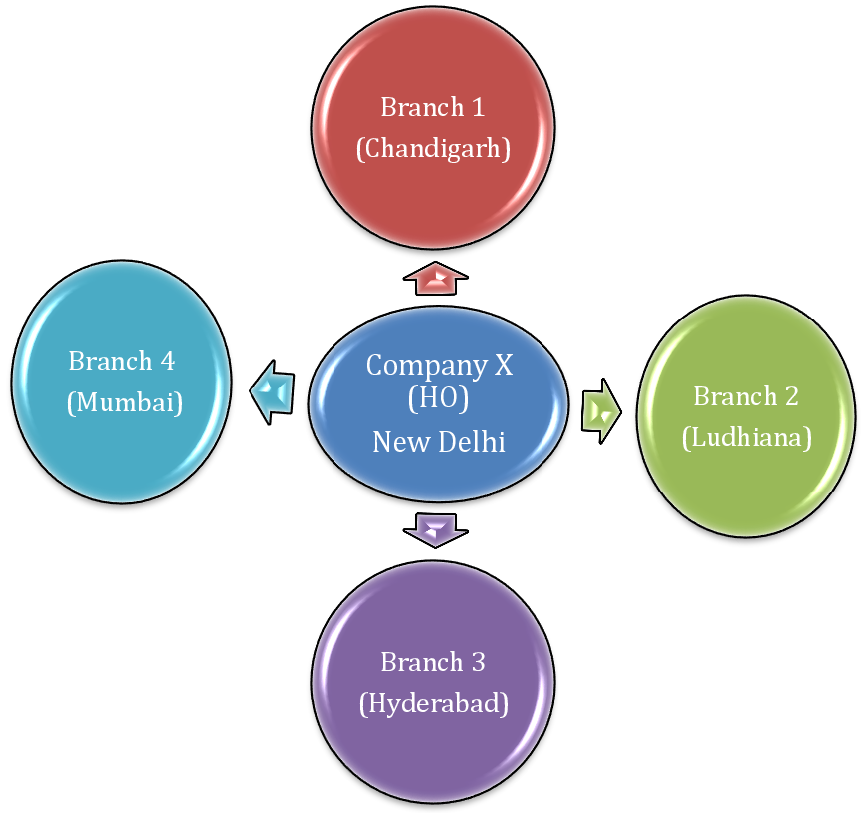

Filling of GST Returns is mandatory for each and every registered entity under GST. Filling of GST returns requires taxpayers to report their taxes well on time to the government and claim ITC on their inputs. Different entities registered as Individual taxpayers, E-commerce entities, Composition dealers have to either file their returns on a monthly or a quarterly basis. Like filling Income tax, the taxpayers under GST will also have to file an additional mandatory annual return specifying details of there annual turnover, sales & purchases made, ITC availed and other necessary information of the required financial year.

Rules for filing GST Annual Return have changed!

Want to file your GST Annual Return?

Tax Goal is an online tax service provider agency based on a cloud setup that provides all require tax filing solutions and compliance assistance on tax-related matters. With our seamless pricing options, you’ll be able to file GST Returns with no additional burden of hiring professionals. For assistance required on GST Annual Return in Delhi email us at support@taxgoal.in

With constant changes in provisions, filing GST annual return has become complex for taxpayers. In this article, we have summarised all about filing GST annual returns with GSTR 9.

GST Annual Return in Delhi

- GSTR 9 is an annual return form to be filed by every registered taxpayer under GST including regular taxpayers, SEZ Units and SEZ Developers.

- It specifies for taxpayers’ turnover of the business, total sales & purchases made, aggregate input availed during the year and demand created, etc.

- GSTR 9 can only be filed by Normal taxpayers other than those registered as Composition dealers, E-commerce entities, Casual or Non-resident taxpayers or ISDs (Input Service Distributors ).

- The return is to be filed by every such taxpayer having a turnover of business below 2 crores. If above Rs 2 crore, an additional reconciling return has to be filed with GSTR 9.

- The due date for filing annual return GSTR 9 is 31st December of the subsequent year for which the return is

Particulars to File in GSTR 9

The following particulars have to be provided while filing the GST annual return with GSTR 9 :

| Part 1 (1 to 3): Basic Details and Nill Return | This section of the form discloses only the basic information of the taxpayers and provides a prompt for filling of Nill annual return . A Nill return can be filed by the taxpayer only if the taxpayer has not:

– Made any outward supply – Made any tax implying purchases – Claimed any credit or refund of taxes – Received ay claim of demand – Be in liability of any tax credit or late fees during the year.

|

| Part 2 (4 to 5): Outward and Inward Supplies | Disclosures in this part have to be made related to taxable, exempted, non-taxable, zero-rated, nill rate supplies and purchases made by the taxpayers.

|

| Part 3 (6 to 8 ): Input tax credit (Claimed, Reversed, Ineligible ITC, etc ) | The section requires details of ITC Claimed, ineligible ITC, Reversed ITC, etc. Most of the entries in the section shall be auto-populated by the system. |

| Part 4 (9 to 14): Taxes paid and Differences | These include details of taxes declared, reported and filed during the year and the transactions made for the next financial year. Here past entries made but not recorded have to be provided as well. |

| Part 5 (15): Demands and Refunds | This requires figures of ITC refund claims made during the year and the demands created, refunds sanctioned, refunds due and claims in questions. |

| Part 6 (16): Other Supplies | It requires details of supplies received from other specific transactions including supplies received from composition taxpayers, goods on approval basis and deemed supplies, etc. |

| Part 7 (17 to 18): HSN Summary of Supplies | This includes HSN wise summary of goods supplied inward or Outward during the year |

| Part 8 (19): Late Fees and Charges | This includes details of fines, charges, penalties imposed on the taxpayer and actually paid. |

Filling GSTR 9 – Online and Offline

The GST department provides two easy options to file GSTR 9 to the taxpayers which can be either filled online or offline.

Filling GSTR 9 Online

Step 1: Login to the GST common portal using your user credentials.

Step 2: Locate to Returns Dashboard > Choose financial year > Select Annual Return GSTR 9.

Step 3: Click on ‘ Prepare Online ‘ and check for the auto-populated figures. (Assure all the figures are accurate before moving to Step 4 )

Step 4: Click on ‘ File online ‘ and Choose any of the Verification options

-Verify Using DSC

-Verify Using EVC

For Offline

Step 1: Login to the GST portal and go to download sections

Step 2: Locate to ‘ Offline tool ‘ section and download the GSTR 9 Offline Tool

Step 3: File requires details in offline mode and generate the file.

Step 4: Locate to Return in common portal and select Annual Return

Step 5: Select the financial year and click on prepare offline

Step 6: Upload the file and Verify it with options available.

Note: As proposed in the 35’th GST Council meet the due date for filing GST annual return for the FY 2017-18 is 30’th August 2019.

File it before the due date with TaxGoal.in in order to avoid penalty of Rs 200/- per day ( Rs 100 for CGST and Rs 100 for SGST ).

For consultation on GST Return Filing Delhi, email us at support@taxgoal.in