For most of us, the term House property is understated. As per the Income-tax Act, 1961 a house property can be a self-accommodated house, office space, shop building or parking lot attached. Any income received on account of any property whether residential or commercial is charged to Tax on Income under the head.

Income from House Property

The Income Tax Act further bifurcates the type of house property to :

- Self-owned property: Property which is not let out by the taxpayer and is used for accommodation purposes of self, spouse, family, and children.

- Rented or let out property: Property let out by the property owner to earn rental income.

- Inherited Property: Property received on inheritance from grandparents or parents used either for self-accommodation or for let-out purposes.

Income from House property can be included in the personal taxable income of the taxpayer only if

- The assessee is the actual owner of the property.

- The property is constituted in the form of a house, building or a plot of land meant for further construction.

- The property is to be used for self-accommodation or for any other purpose except for business or professional purposes.

Computation of Taxable Income from House Property

- Calculate GAV ( Gross Annual Value )( Section 23): The gross value of the property for the year can be determined as higher than the following

– Expected Rent ( ER ) = Higher of ‘fair rent of any similar property’ or ‘Municipal value’

– Actual rent receivable.

For the self-occupied house, GAV is zero.

- Calculate total municipal taxes (taxes on property): Compute total of taxes actually paid by the owner during the taxable previous year.

- Net Annual Value (NAV): Subtract total taxes paid out of the Gross annual value of the property calculated in Step 2 and Step 1 respectively.

- Reduce Eligible deductions (Section 24 ): A standard deduction of 30% of NAV ( Section 24(a) ) can be claimed in addition to the deduction for interest paid on home loan (Section 24(b)) taken for acquiring such property /for construction/ for repair/ for renewals or for related purposes.

The left out amount is taxable under Income from house property. If it brings out a loss, it can be adjusted against income from other heads or as the case may be.

Deductions on Income from House Property

- A Standard deduction under Section 24 for up to 30% of NAV has been allowed.

- Deduction of up to Rs 2 lakh on interest on the loan paid for such house property can be claimed if the property is self-accommodated by the taxpayer, while the full interest amount is exempted if the property is rented out.

- Deduction said above will only be allowed for Rs 30,000 if the construction of the said property is not completed within 5 years.

- Deduction on interest on the loan is taken for a pre-construction period and can also be availed but only after completion of construction and in 5 equal instalments for the next 5 Financial years.

- Deduction for rent unrealized rent from the defaulting tenant. (Section 23)

- Deduction on account of rent received of previous years shall be considered as deemed income of the taxpayer for which the rent is received. A deduction for such rent up to 30% (Section 25A).

Know more about deductions available on house loans here

Set-offs and Carry forward of losses from Income from House Property

- A taxpayer is allowed to set off losses from house property with income from the income of any other house property ( Section 70 ).

- A taxpayer is allowed to set off losses from house property from other heads of income but not from casual income (not likely to occur in future)( Section 71 ).

- The losses on account of Income from house property can be adjusted/carried forward for the next 8 years.

Need support on payroll management?

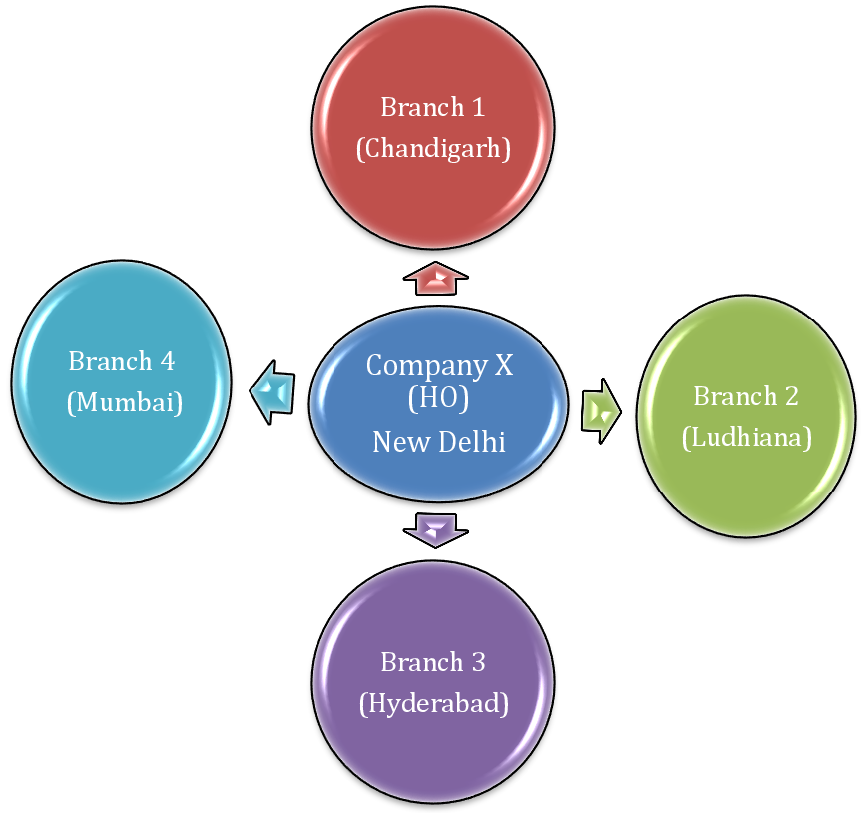

TaxGoal.in a reputed ITR service provider in Delhi, which serves you with the most hassle-free ITR filling solutions and payroll services to all major parts of India. We guide our prospects on all payroll services in Delhi and always work on the front roads to solve your financial worries.

Email us at support@Taxgoal.in