Audit Rules for Share Trading and Derivatives

Stock market trading is a vast subject to understand. Traders in the stock market business undertake to buy or sell securities of different companies to either achieve their long-term financial goals or book some good profit on a day-to-day basis. Investing for the long term, the traders either achieve appreciation on their investment or they suffer losses due to market fluctuations. While working on an Intra-day basis, traders have to buy or sell securities on the same day to take benefit of price fluctuations.

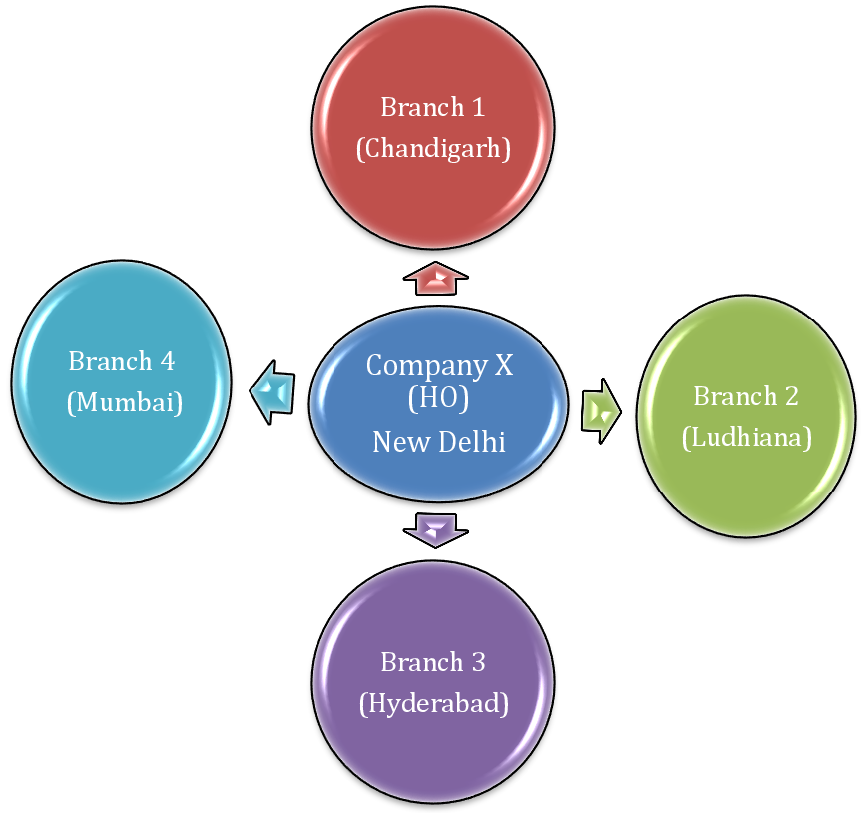

Considered a normal business activity under Income tax norms, Individuals and all trading organizations dealing in the trading of securities are considered as taxpayers under the Income tax Audit Act, 1961 and are required to report their income and taxes as per their applicable tax slab rates. There are a lot of misconceptions in the mind of Individual taxpayers relating to reporting of Income from securities while filing their tax returns. Also, the act provides for audit provisions for all taxpayers who other than having other income sources also receive income from trading of these securities. Taxgoal is a leading financial service provider agent that also provides Share Trading Audit Service in Delhi.

In this post below you will get to know all about “ What audit provisions are there for reporting of trading income for taxpayers in the Income Tax Act? “

Trading in Securities

Insecurities market, an investor can generate income by way of:

- Investing and trading on Intra-day Basis: Where the securities are bought and sold on a single day basis. In case, the share or the security bought by the investor strikes up from the buying price, the investor earns a profit else he ends up paying losses.

- Delivery Trading: In such type of trading, the trader purchases some securities or invest in future or options to redeem them at a higher price in future. In such trading, price movement is tracked by the investor, and if the value appreciates he might sell the security or retain it till he gains more profit.

- Short Selling: In such trades, the investor sells the securities even without holding them and buys them before the end of the trading session. In short, it means buying securities when they are at high prices and buying them back when they are at low price.

- BSTS (Buy Today Sell Tomorrow) Trading: In such trades, the investor buys the securities today to sell them tomorrow. The difference between delivery trading and BSTS is that in delivery trading selling of securities only be done after the delivery of securities.

- STBT (Sell Today Buy Tomorrow) Trading: In such trades, it just the opposite of BSTS trade and available only in few securities. In this selling by traders is done before buying.

- Margin Trading: It is usually done in Intra-day trading of future & options where the investor has to pay a certain margin to the broker firm to buy certain shares without actually paying the whole value of the security. For instance, sometimes of securities worth Rs 50,000 can be purchased within a margin of Rs 10,000 for trade.

Tax Provisions for Traders

If securities are held for long term benefits I.e to be sold within 12 months or after 12 months: They shall be considered as investments for gains or losses and are accounted under provisions of Capital Gains under the Income Tax law. For securities purchased and sold within a year, the gains arising out of it shall be considered as short term capital gains, while if held and sold after 12 months, gains out of it shall be taxed under the provisions of long term capital gains. In such cases, provisions for STCG (Short term capital gains ) & LTCG (Long term capital gains) shall be computed as per Section 111A, Section 112, Section 112A, and Section 73 of the IT Act, 1961.

If securities held for intraday trade: Where securities are held for a single day and sold within the same day, in such trade, any income arising out of such transaction shall be considered as a speculative income The Section 43(5) of the Income Tax Act, provides for the implication of tax rules on Intraday transaction of securities.

Audit Rules for Traders

Tax Audit for Equity-Based Intra-day Traders :

Income from Intra-day trading of securities, whether received from trading of equity or futures, income in such cases shall be treated as a speculative income. As per Section 43(5) of the IT Act, speculative income shall have to add to the normal taxable income of the taxpayer, which will be charged as per applicable tax slab. A taxpayer also has an option to disclose his speculative income as Presumptive business income under Section 44AD or as Normal business income I.e income of the person will be taxed as individual tax slab.

If considered as presumptive income from a business , then the provisions of Section 44AB (Income Tax Audit ) shall become applicable on the taxpayer if business turnover is more than Rs 2 crore (FY -2019-20 ) or Rs 5 crore (FY – 2020-21) and in normal business income case if it exceeds Rs 1 crore (subject to change).

Calculation of Trading Turnover

The trading turnover as per Section 44AB, have to be computed in the following way :

Intraday Trading Turnover: Sum of Daily Absolute Profit – Sum of Daily Absolute Losses

For instance, if a taxpayer did intraday trade for only 10 days in shares of Reliance company in the entire financial year, his trading turnover shall be calculated as :

Earnings of 10 days = +2000 , -560, +8100,-2600 , +1000,+1250,-600,+4580,+2300,-1100

Turnover for FY = 2000-560+8100-2600+1000+1250-600+4580+2300-1100 = 14370

Note: If business income is computed under Section 44AD, the total turnover of the taxpayer for the limit prescribed under Section 44AB (Business turnover < 2 crores and profit of business < 6% of turnover ) shall be considered after inclusion of trading turnover in the business turnover.

Tax Audit for Traders in Future & Options:

For traders of derivatives like futures & options, the total turnover can be determined by :

Doing a summation of all favourable and unfavourable differences plus including premiums received on the sale of options.

For instance, if 100 units of NIFTY are bought at Rs 9000 and sold at 8999, then the difference of Rs 1000*100 – 10,000 shall be considered as turnover for such trade. Summation of all such trades within an FY shall be considered for Tax Audit under Section 44AB.

Tax Audit for SCTG and LTCG Transactions of Securities

There are a lot of misconceptions about the trading of securities on a held-and-sell basis, where the taxpayer has to calculate turnover from such transactions or report the profits or losses as STCG and LTCG.

So a clear explanation of this can be :

If you are declaring equity-based trades as business income also then turnover for delivery trades are also to be calculated. For instance, if 100 shares of LUPIN Pharmaceuticals are purchased for Rs 999 = Rs 99,900, the turnover of business should include turnover from equity trades also.

If you are declaring it under LTCG and STCG on investments, then no such turnover has to be computed, and hence then no audit under Section 44AB shall be required in such case.

If securities are held for a period of fewer than 12 months then STCG (Section 111A) on earnings from such investment shall be charged at a rate of 15%. While for LTCG (Section 112A) -I.e for investments made for above 12 months period the rate shall be 10%.