What is the Reverse Charge Mechanism? Mr. A is a small trader of goods in Delhi having turnover below 20 Lakhs and purchases goods from a supplier who is not registered under GST, does he require to take GST registration under Reverse Charge Mechanism (RCM) in Delhi?

Normally, the supplier of goods or services pays the tax on supply. In the case of Reverse Charge, the recipient of goods or receiver becomes liable to pay the tax, i.e., the chargeability gets reversed.

There is a threshold limit for turnover aggregating to Rs 20 lakh (Rs 10 Lakh for northeastern states) for registration for normal taxpayers but under reverse charge, there is no such limit. The person has to be registered under GST irrespective of the aggregate limit. Therefore Mr. A is required to obtain GST Registration in Delhi.

NORMAL MECHANISM OF LEVY OF GST

REVERSE CHARGE MECHANISM OF LEVY OF GST

APPLICABILITY OF REVERSE CHARGE MECHANISM

When a Registered Dealer receives goods or services from an Unregistered Supplier

- When an unregistered vendor supplies goods to a registered person then Reverse Charge is applicable. In such case Goods & Services Tax will have to be paid directly by the receiver to the Government instead of the supplier.

- The registered dealer has to do self – Invoicing for the GST to be paid under reverse charge basis.

- In case of Inter-state purchases the recipient has to pay IGST. While for Intra-state purchases CGST and SGST has to be paid under RCM by the recipient.

- Example: Mr. A, a registered dealer under GST purchases goods worth Rs 50000/- from a unregistered supplier Mr. B. Hence in this case RCM would be applicable and Mr. A is applicable to pay GST to government under reverse charge.

Services offered by an aggregator or e-commerce operator

- If an e-commerce operator supplies services then reverse charge will be applicable to the e-commerce operator. He will be liable to pay GST under RCM.

- For example, XYZ Pvt. Ltd provides services of carpenters, drivers, make up artists, therapists etc. Hence XYZ Pvt. Ltd is liable to pay GST and collect it from the customers instead of the registered service providers.

- In case e-commerce operator does not have a physical presence in the taxable territory, then a person representing such electronic commerce operator for any purpose will be liable to pay tax. If there is no representative, the operator will appoint a representative who will be held liable to pay GST.

On Goods & Services notified by Central Board of Excise and Customs. (CBEC)

Time of Supply Under Reverse Charge Mechanism

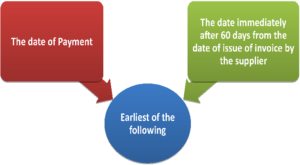

Point of time, which determines when the goods or services are rendered or supplied. It allows us to find out the tax rate, value and due dates for filing returns.

In case of Goods, Time of Supply shall be

Example:

- Date of Payment – 18th July 2018

- Date of Invoice – 1st August 2018

- Date of Entry in books by recipient – 19th July 2018

In this case, the time of supply will be 18th July 2018.

If Supplier is from outside India, Time of Supply shall be

Example:

- Date of Payment – 18th July 2018

- Date of Entry in books by recipient – 19th July 2018

In this case, the time of supply will be 18th July 2018

In the case of Services, the Time of Supply shall be

Note: However if it is not possible to determine the time of supply due to some reason, then the Date of Entry in the Books of accounts of the recipient shall be considered to be the time of supply.

Example:

- Date of Payment – 18th July 2018

- Date of Invoice – 1st August 2018

- Date of Entry in books by the recipient – 19th July 2018

In this case, the time of supply will be 18th July 2018. If the time of supply can’t be ascertained due to some reason under 1 or 2 head, in this case, it will be 19th July i.e., the date of entry in books by the recipient shall be a time of supply.

Self Invoicing

Self-invoicing is necessary in case of purchases of goods or services from an unregistered supplier who falls under reverse charge because the supplier cannot issue a GST-compliant invoice to you and you become liable to pay taxes on their behalf.

Every registered person who is paying tax based on reverse charge has to “Tax applicable on Reverse Charge” in his tax invoice that is being issued.

Mandatory Requirements under Reverse Charge Mechanism (RCM)

ITC on Reverse Charge

The buyer is eligible to claim Input tax credit on goods and services they bought on reverse charge basis provided they are being used for business purposes only.

| Type of Person | Type of Supplies | Eligibe for ITC |

| Buyer (Registered under GST) | RCM Supply of Goods or Services | Yes |

| Supplier (Not Registered under GST) | RCM Supply of Goods or Services | NO |

Exemptions under reverse charge

GST under the reverse charge mechanism is not required to be paid by a registered business owner on intra-state purchases from unregistered sellers, as long as the total value of the supply received per day is less than or equal to Rs.5,000/-.