Who is an Input Service Distributor under GST regime?

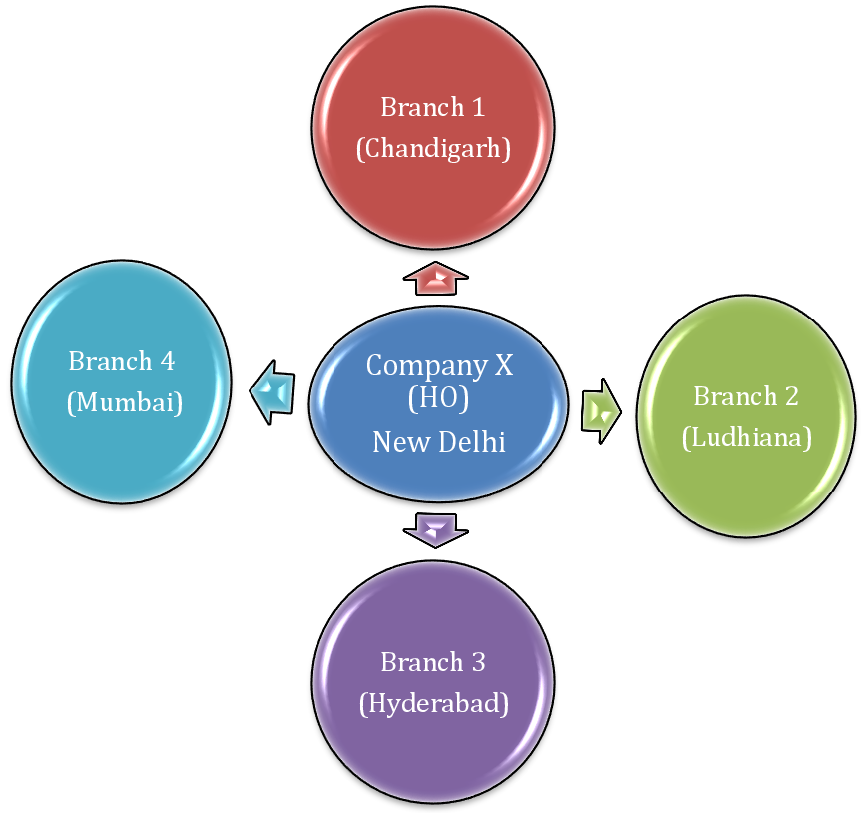

Input Service Distributor is a central office (HO) of a tax payer, which receives common input tax invoices from goods and service providers and further distributes the Input tax credit to individual units i.e. to branches on a proportionate basis.(Branches may have different GSTN number but they should have same PAN as that of ISD)

Example: Company X has head office situated in New Delhi and has four branches situated at Chandigarh, Ludhiana, Mumbai and Hyderabad. The Head office at New Delhi incurred Advertisement expense for its four branches and received the invoice for the same. Since the expense is incurred for the branches, thus input tax credit needs to be distributed among the branches in the ratio of their turnovers. The Head office at New Delhi shall be registered as an Input Service Distributor (ISD) for the purpose of distributing credit to its branches.

On which items distribution of ITC by ISD is not allowed?

- The credit of tax paid under the reverse charge mechanism (RCM)is not available for distribution. So, the ISD has to utilize such credit only as a normal taxpayer.

- Similarly the credit of tax paid on normal goods and capital goods like machines, stock etc is not available for distribution. Hence, ISD can utilize the credit on capital goods and normal goods as a normal taxpayer only.

Crux: Only Credit of Services is available for distribution by the ISD

| Type of Credit | Availability of ITC |

|---|---|

| Input Services (Advertisement, Software Maintenance etc) | Yes |

| Reverse Charge Mechanism | NO |

| Input Goods Purchased (Like Raw materials, Stock etc) | NO |

| Capital Goods Purchased (Like Machines etc) | NO |

Registration and Filing Returns by ISD under GST

Registration under GST requires business to be registered separately as an ISD. It is mandatory to apply afresh for registration.

ISD is required to file returns 13 times in a year (12 monthly and 1 annually). The form GSTR-6 is required by ISD to file returns.

| Type of Form | Frequency | Particulars to be Filed | By Whom | By When |

| GSTR-1 | Monthly | Details of outward supplies of taxable goods and/or services effected to ISD | Suppliers | 10th of Next Month for all supplies of previous Month |

| GSTR -6A | Monthly | Details of Inward Supplies are auto populated on the basis GSTR-1 filed by the supplier | Auto update through GSTN server | 11th of Next Month for all invoices of previous Month |

| GSTR-6 | Monthly | Details of outward supplies of taxable goods and/or services effected claiming input tax credit | Input Service Distributor | 13th of Next Month for all invoices of previous Month |

Note: For filing GST returns, businesses can register as both “Supplier of Service” and an “Input Service Distributor” simultaneously. A different number would be provided for this application.

How an Input Service distributor (ISD) distributes Input Tax Credit (ITC)?

- The tax credit available against any specific input service used entirely by one of the recipients can be allocated only to that recipient for utilization of such credit and not to other recipients.

Example 1: Company X has a Head Office in New Delhi and two branches in Jaipur and Chandigarh respectively. Head Office incurs Rs 100000/- (ITC is Rs 18000/-) as advertisement expense solely for Jaipur Branch, Hence entire Input Tax Credit of Rs 18000/- can be distributed to Jaipur Branch by the Head Office.

- The tax credit available against the input services used commonly by more than one recipient shall be allocated to those recipients on a pro-rata basis in the ratio of turnover of all such recipients that are operational during the year.

Example 2: Company X has a Head Office in New Delhi and two branches in Jaipur and Chandigarh respectively. Head Office incurs Rs 100000/- as (ITC is Rs 18000/-) advertisement expense for both the branches. Jaipur and Chandigarh branches have turnover Rs 1 lakhs & Rs 2 lakhs respectively. Hence Tax Credit of Rs 18000/- shall be distributed to Jaipur and Chandigarh branch in the ratio of their turnover i.e. 1:2 .

| Branch | Turnover | Ratio | ITC Distribution |

| Jaipur | 1,00,000.00 | 1 | 6,000.00 |

| Chandigarh | 2,00,000.00 | 2 | 12,000.00 |

| Total | 3,00,000.00 | 3 | 18,000.00 |

Example 3: M/s ABC Ltd, having its head Office at New Delhi, is registered as ISD. It has three units in different states namely ‘New Delhi’, ‘Gujrat’ and ‘Ludhiana’ which are operational in the current year. M/s ABC Ltd furnishes the following information for the month of August, 2017 & asks for permission to distribute the below input tax credit to various units.

- CGST paid on services used only for New Delhi Unit: Rs. 400000/-

- IGST, CGST & SGST paid on services used for all units: Rs. 1500000/-

Total Turnover of the units for the Financial Year 2016-17 are as follows: –

| Unit | Turnover (Rs.) |

| Total Turnover of three units | Rs. 12, 00, 00,000 |

| Turnover of New Delhi unit | Rs. 6, 00, 00,000 (50%) |

| Turnover of Gujrat unit | Rs. 3, 60, 00,000 (30%) |

| Turnover of Ludhiana unit | Rs. 2, 40, 00,000 (20%) |

Computation of Input Tax Credit Distributed to various units is as follows:

| Particulars | Credit distributed to all units | |||

| Total credit available | New Delhi | Gujrat | Ludhiana | |

| CGST paid on services used only

For New Delhi Unit. |

400000 | 400000 | 0 | 0 |

| IGST, CGST & SGST paid on services used in all units-

Distribution on pro rata basis to all the units which are operational in the current year |

1500000 | 750000 | 450000 | 300000 |

| Total | 1900000 | 1150000 | 450000 | 300000 |

Note: The business unit to which the input tax credit is distributed is known as the ‘recipient of credit.’

Distribution of Input Tax Credit – According to state

| Manner of distribution of Input Tax Credit | ||

| Input Tax Credit with ISD | ISD & Recipient located in same State | ISD & Recipient located in different State |

| IGST | IGST |

IGST |

| CGST | CGST | |

| SGST | SGST | |

| UTGST | UTGST | |

What are the Conditions for qualifying as an Input Service Distributor?

- The Input Service Distributor should be an office of the supplier, such supplier can be a supplier of goods or services or both;

- Compulsory Registration is required by the Input Service Distributor as an “ISD” apart from its registration as a normal taxpayer under the Act, wherein he has to specify under serial number 14 of the REG-01 form as an ISD.

- Such office should receive tax invoices issued in respect of receipt of input service. Tax invoices received in respect of input goods are not eligible for ISD benefits;

- Such office should issue a prescribed document for the purposes of distributing credits of CGST, SGST, IGST or UTGST, to a supplier of taxable goods or services or both having same Permanent Account Number as that of the said office.

- Input Tax Credit distributed should not exceed the amount of tax credit available with the ISD at the end of a relevant month to be filed in GSTR-6by 13th of the succeeding month by ISD.

Exception for Insurer, Banking or Financial Company or NBFC

If supplier of taxable service is an insurer or a banking company or a financial institution, including a non-banking financial company, then;

- A tax invoice or any other document or by whatever name called can be issued;

- Whether issued or made available, physically or electronically

- Whether or not serially numbered, and

- Whether or not containing the address of the recipient of taxable service

But containing other information as mentioned under rule 46.

Conclusion

Thus the concept of ISD is a facility made available to business having a large share of common expenditure and billing/payment is done from a centralized location. The mechanism is meant to simplify the credit taking process for entities and the facility is meant to strengthen the seamless flow of credit under GST.